Municipal bonds have long been seen as a safe haven in the bond market. After all, their credit quality and repayment are driven by the state’s and the local government’s ability to raise taxes and/or support from the underwritten projects. This cash flow pays investors and provides the steady returns of muni bonds.

And it looks like municipal bond investors have something to cheer about heading into next year.

State tax revenues are set to increase, while rainy day funds remain plump. At the same time, budget and spending cuts even in the worst-off states have less cash flow risks for many municipalities. For investors, it’s just another sign that munis are a top bond variety for their portfolios.

Taxes, Taxes, Taxes

Municipal bonds are issued by state and local governments to fund their operations, launch special projects, and provide their citizens with various programs. To pay for those bonds, it’s often taxes–payroll, sales, and property–that help pay the interest and pay off debt. This is where some problems have emerged over the last year.

Tax revenues have been mixed at best.

The Federal Reserve’s higher interest rate environment was designed to slow the economy. And it did slow the economy. A variety of growth metrics have slipped. This has included incomes, property values, and consumer/business spending.

That’s an issue for states and local governments. They simply have brought in less money in the last two years or so.

After post-pandemic surges, 2023 state revenues were estimated to decline by 1.1%. While the National Association of State Budget Officers (NASBO) tallies for this year haven’t been completed with roughly three months left to the year, we can safely say tax revenues will be slightly above or flat for the year.

For investors, this presents a problem. Tax declines reduce the amount of money collected that can be used to pay back bonds and interest.

A Better Cash Flow Situation

However, 2025 could prove a much better year for municipalities and their bondholders. That’s the gist according to a new missive from asset manager Northern Trust. It turns out the state’s taxes and their rainy day funds are set to increase, providing plenty of safety for their budgets and bonds.

For starters, state balance sheets are full of cash.

An influx of pandemic-issued cash has helped many states grow their rainy-day balances to levels not seen before. According to Northern Trust, total ‘rainy day fund’ reserve balances have grown to $136 billion by the end of fiscal 2023. This is up from just $77 billion in 2020 and $135 billion in 2022. And while a $1 billion year-over-year increase may not seem impressive, remember, last year saw declining tax revenues. All in all, median rainy day reserves have now increased to over 13% of annual budgets, a level not seen in over 15 years. Those balances jump to 23% of annual budgets when including other funds in the states’ coffers.

Speaking of those budgets, states have been proactive in reducing spending amid lower tax receipts. Analysis by the Pew Charitable Trust shows that states’ expected general fund spending will decline by 6% for fiscal 2025. That drop in spending is equal to the cuts experienced during the Great Recession/Global Financial Crisis. The cuts have come from a variety of states. For example, California reduced one-time spending to reallocate resources to core services, while Arizona cut higher education spending to close deficits.

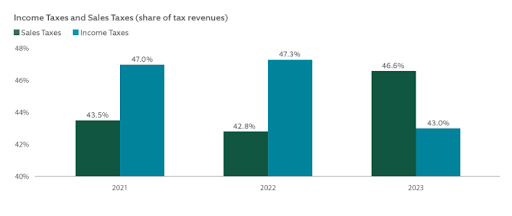

Finally, the kinds of taxes many states are starting to collect have changed. Income taxes—which were often the main source of revenue—have given way to other tax collections including consumption and sales taxes. The legalization of cannabis has provided a tailwind for many states, while income tax cuts coupled with rising sales tax increases have provided more revenues and changed revenue makeup.

As you can see, sales tax now provides more than 46.6% of the state’s annual tax haul.

Source: Northern Trust

The result according to Northern Trust is more states have better resilience to shocks and budget issues. That’s great news for municipal bondholders.

A Big Win For Munis

The big rainy-day funds, changes to tax collection, and lower spending are all great news for municipal bonds and their investors. Munis are already known for their top credit quality and now that quality has been enhanced.

This is a particularly strong win when you consider munis are their high after-tax yields. Today, you can still buy munis with after-tax yields that exceed corporate bonds at 6.3%. That’s a big win considering the sunsetting of the Tax Act and the fact that bond interest is taxed as ordinary income. That can be as high as 40% for some investors.

With munis, investors can get better credit quality than corporate bonds that are only strengthened and have a juicy after-tax yield.

With that, adding a dose of municipal bonds heading into the new year makes a ton of sense. ETFs—whether active or passive—are the correct way to use them in a portfolio. Low costs and board mandates allow investors to build a wide swath of bonds with one ticker. Passive options offer a little bit of everything. Going active could provide better returns as managers can focus on values or states with better resilience than others. There’s plenty of evidence that active management in munis can lead to better returns.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from -0.5% to 0.9%. They have expense ratios between 0.05% to 0.65% and assets under management between $1.2B to $37B. They are currently yielding between 1.9% and 3.7%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.9B | 0.9% | 3.1% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.47B | 0.5% | 3.7% | 0.35% | ETF | Yes |

| SUB | iShares Short-Term National Muni Bond ETF | $8.7B | 0.0% | 2.2% | 0.07% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $34B | 0.0% | 3.1% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $1.23B | -0.1% | 3.1% | 0.19% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $36.8B | -0.2% | 3.1% | 0.05% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | -0.5% | 1.9% | 0.20% | ETF | No |

All in all, states continue to strengthen their financial positions with budget cuts, high revenues, and fat rainy-day funds. This is all wonderful news for muni credit quality. It’s that quality and cash flows that make these bonds strong. Now, they are getting even better than in the last couple of years.

Bottom Line

After a few years of mixed revenue collection, states are back in the swing of it. Taxes are expected to rise, while spending is projected to be way down. Adding in large rainy-day funds and munis can be a top high-yielding bond for fixed income investors.